AMD's CPU mix and margins

In terms of Computing Solutions, it is extremely important to consider AMD's mix between single- and dual-cores, as well as between clients and server. Here's a quote from seekingalpha.com's Q406 conference transcript:

Dirk R. MeyerYes, improve the mix is again a funny one. Just for reference though, dual-core mix in our product line in Q4 was roughly about a third. We’ve got an opportunity to accelerate that as a percentage of our overall product line going forward. Probably more rapidly then, the product gets pushed down the price stack as we go to an increasing fraction of 300-millimeter manufacturing and 65-nanometer technology. So I actually think that increased dual-core mix for us represents an ASP and margin upside in the near-term.

This implies that about 65% of AMD's CPUs unit sales are still single-core; more importantly, this is most likely for the client and server spaces combined so you'd expect 70% of their sales in desktops and laptops to be single-core products because servers are more frequently dual-core than clients.

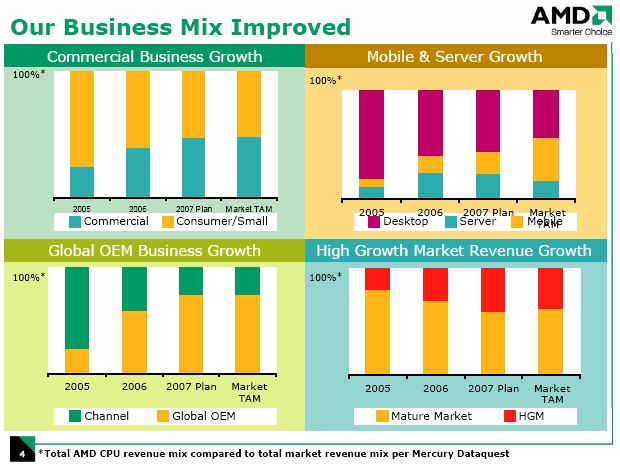

In terms of the mix between desktops, laptops and servers, Henri Richard's presentation for the 2006 Analyst Day gives significant insight there. This single slide includes a lot of information on AMD's business mix:

Source: http://www.amd.com/us-en/Corporate/InvestorRelations/0,,51_306_14668,00.html

These graphs compare AMD's current product mix to that of the overall x86 CPU market. Of particular interest is the proportion of AMD's revenue that is related to their server CPUs. It's about 23% in 2006, which implies it's only a little bit above their average server marketshare for the year. The higher ASPs are thus compensating the lower volumes. In terms of gross profits however, server products are a much larger part of the pie since their margins are better. There are no public numbers out there that we can find, but we'd expect server CPUs to represent at least 35% of gross profit.

It is fairly difficult to estimate the single-core/dual-core ratio in terms of revenue and gross profit, because the ASPs aren't known. It could be assumed that the average dual-core processor sells for about twice as much as the average single-core processor, but that's most likely horribly mistaken. However, these numbers do highlight that AMD still has a very significant portion of its sales in the single-core market, and thus price cuts in there will affect it just as much - if not more - than in the dual-core market. Secondly, it means that as the prices of dual-core processors lower, the relative presence of single-core products on the market will decrease. Right now, AMD has a performance advantage in single-cores (as Intel's offerings are still based on Netburst there) and a disadvantage in dual-cores. Clearly, this is working in Intel's favour.

For the Q107 quarter, no less than three price cut rounds will affect AMD's bottom line. These occured on October 23, January 22 and February 12. The first one counts because part of Q406 wasn't affected, while obviously the two latter only affect (a large) part of Q107. In addition to that, AMD got quite aggressive with rebates in December apparently, but the impact of that is probably not overly significant and it would be quite hard to quantify either way. One way to evaluate the impact of price cuts on a company's margins is to consider what these cuts imply for the ASPs of all the products in its line-up. To take a basic example, if all models of a given chip had their clocks increased by xMHz (such as there would be a new upper-end model and the previous lowest-end model would be discontinued), mid/long-term margins would not be affected as long as yields are not reduced.

From that point of view, however, AMD's price cuts definitely should impact margins very significantly, as higher-end models are not getting replaced (or, are getting replaced with products unlikely to get much traction in the marketplace) while the lowest-end models are not systematically getting phased out. As such, the ASP of any given chip is affected very negatively, while there is no reason to believe that production is getting substantially cheaper over time.